Search

Featured Articles

By our in-house experts

Jun 25, 2025

5 Contract Bottlenecks Slowing Down Your Legal Team

Manual contracts, slow approvals, siloed legal know-how – these bottlenecks cost your business time and money. Discover the 5 most common blockers and how Pocketlaw helps you streamline legal work to move faster and stay compliant.

Jun 11, 2025

Whitepaper: The In-House Counsel's Guide to Prompting

Learn how in-house legal teams can prompt AI tools more effectively. Get practical tips, real examples, and a cheat sheet. Download the free whitepaper.

Apr 17, 2025

Legal Tech Tools Buyer's Guide 2025: 10 Key Considerations

Discover 10 essential factors to evaluate before investing in legal tech - from AI and security to scalability. Make smarter decisions for your legal team.

Expert Guides on Contract Processes

Stay updated with the latest trends & insights in legal tech.

May 28, 2025

What Is Contract Acceptance?

Contract acceptance is the clear, unconditional agreement to an offer, creating a legally binding agreement between parties.

Mar 18, 2025

13 Effective Strategies for Contract Negotiation

Learn contract negotiation strategies with tips on preparation, active listening, and using AI tools for better agreements and lasting partnerships.

Mar 18, 2025

How to Execute a Contract

Learn how to execute a contract properly, from drafting and reviewing to signing and post-signing management, ensuring legal validity and efficiency.

Mar 18, 2025

AI for Legal Documents in 2025: Use Cases, Trends & Tools

Discover AI for legal documents in 2025: Explore advanced tools and trends that revolutionize contract review, research, and workflow automation.

Mar 18, 2025

What Is an Addendum?

An addendum modifies a contract without altering its core terms. It’s used for deadline changes, pricing updates, or additional services, ensuring flexibility while maintaining legal clarity.

Mar 18, 2025

10 ChatGPT Use Cases for Lawyers & Legal Teams

Discover how ChatGPT enhances legal research, drafting, and compliance while understanding its limitations and the best ways to use AI effectively in legal practice.

Mar 18, 2025

Legal AI Tools for Lawyers & Legal Teams in 2025

Explore the top legal AI tools for 2025, from document review to contract management, helping legal teams automate tasks and enhance efficiency.

Mar 18, 2025

9 Best ChatGPT Prompts for Legal Professionals

Discover the best ChatGPT prompts for lawyers to enhance legal tasks like contract drafting, research, and client communication with efficient, accurate results.

Feb 19, 2025

How to Write AI Prompts for Legal Work in 2025

Learn how to write effective legal AI prompts by focusing on intent, clarity, context, and refinement to improve accuracy, compliance, and workflow efficiency.

Product Updates

Latest product information and guides.

Oct 30, 2023

AWS trusts us, why wouldn't you?

Access Pocketlaw’s legal tools easily on the AWS Marketplace. Simplify your legal tasks with our innovative platform. Find out how.

May 9, 2023

Pocketlaw achieves ISO 27001 compliance

Discover Pocketlaw's dedication to data security through achieving ISO 27001 compliance. Ensuring trust and integrity in our legal solutions.

Feb 13, 2024

Embrace the Power of Legal AI and Transform your Legal Processes

Discover how Pocketlaw's Legal AI-powered features are changing in-house legal teams & contract processes. Streamline tasks, reduce errors, & save time with AI

Product Guides

Latest product information and guides.

May 7, 2024

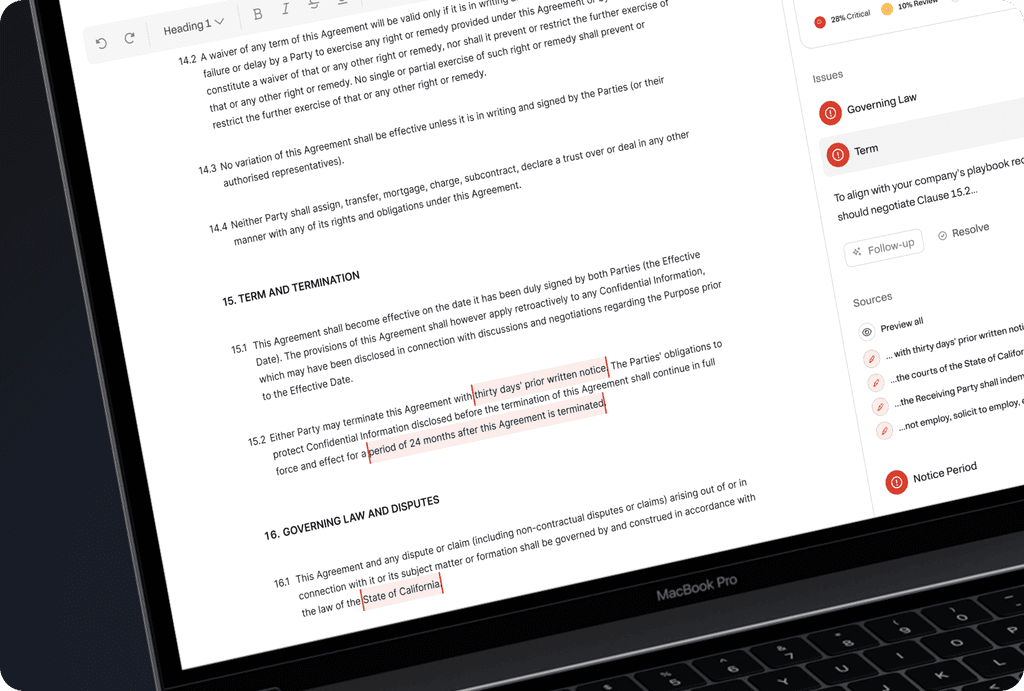

Simplifying Contract Review with AI: Buyer's Guide

Discover AI's impact on contract review. Save time, and money & mitigate risks. Find the perfect solution in our AI contract review buyer's guide

Mar 19, 2024

AI Metadata Labelling for Simplified Contract Management

Transform your contract management with AI metadata labelling. Streamline processes, enhance accuracy, and simplify document handling effortlessly.

Mar 19, 2024

Redlining - Understanding Legal Document Redlining A Detailed Guide

Master the process of legal document redlining with our detailed guide. Learn the techniques and best practices for effective document negotiation.

Customer Studies

Customers sharing their experiences and success stories.

Pocketlaw makes me sleep better at night

See how Cambio Healthcare Systems saved time and improved contract management with Pocketlaw’s AI-powered legal tools.

One solution for five countries

See how Strömma streamlined contract management across five countries with Pocketlaw’s AI-powered CLM tools, improving efficiency and collaboration.

From a fragmented system to a streamlined workflow

See how Teya used Pocketlaw to automate contracts, standardize legal processes, and improve efficiency, reducing contract turnaround time from weeks to days.

Contract Templates

Access templates by our expert lawyers.

Jan 4, 2024

What is a Share Purchase Agreement

Delve into the intricacies of share purchase agreements & their importance in business transactions. Discover how to draft an effective agreement with Pocketlaw

Oct 3, 2022

Board Minutes

Ensure accurate & efficient board meeting minutes with Pocketlaw's guidelines, streamlining your corporate governance & record-keeping processes.

Apr 13, 2021

Shareholders' Agreement - a Comprehensive Guide To What They Are & When to Use Them

Secure your company's future with a solid shareholder agreement, using Pocketlaw's expert guidance to ensure clarity and prevent disputes.